Digital transformation is a must in the insurance industry. Customers want seamless user experiences, instant claim processing, and personalized services. To meet these expectations, insurers rely on cutting-edge technology. Deploying such solutions without rigorous testing causes errors, security breaches, and dissatisfied customers. This is where quality engineering testing steps in as a game-changer.

Let’s explore how quality engineering in automation testing enhances insurance applications. It ensures reliability, scalability, and customer satisfaction.

Why Insurance applications need quality engineering

Insurance applications are complex. They handle sensitive customer data, process millions of transactions, and operate across platforms. Here’s why software quality engineering is critical:

- Customer experience matters: Smooth interfaces and bug-free applications please customers and build trust.

- Data sensitivity: Stringent testing secures sensitive personal and financial data.

- Regulatory compliance: Testing helps insurers meet compliance standards. It also helps them avoid hefty penalties.

- Easy integration: Insurance apps need to work with older systems. It includes external APIs and payment gateways.

In such a demanding ecosystem, relying on traditional testing methods is not enough. Quality assurance companies now use advanced quality engineering techniques. It helps them tackle these challenges head-on.

The role of quality engineering in insurance applications

Quality engineering in automation testing combines robust frameworks, automation tools, and strategic planning. This enhances insurance software. Let’s dive into the core aspects:

1. Automated testing for speed and accuracy

Automation transforms the testing process by reducing manual intervention and increasing efficiency. Key benefits include:

Automated testing offers many benefits for insurance applications. It speeds up testing cycles by reducing the time needed by up to 50%. This enables faster rollouts of updates and features. Automation ensures better coverage by testing claims processing, underwriting workflows, and customer portals. It delivers accurate results, eliminating human errors and ensuring reliable performance. This combo of speed, coverage, and precision makes automation critical for modern systems.

Tools like Selenium, Appium, and Cypress help quality assurance companies simulate real-world scenarios. They help ensure the robustness of insurance applications.

2. Performance engineering for scalability

Insurance applications must handle high traffic during peak times. Such cases include policy renewals and disaster claims. Software quality engineering focuses on:

Performance testing is crucial for ensuring insurance applications meet user expectations. Load testing can check how well systems handle heavy user loads. This is to ensure they remain stable during peak usage. Stress testing goes a step further by pushing systems beyond expected usage levels. It can identify their breaking points and potential vulnerabilities. With these insights, optimization is carried out to fine-tune the application. This process improves speed and response times, ensuring a seamless experience for users.

By employing performance engineering, insurers can deliver scalable applications. They can handle fluctuating demands with ease.

3. Security testing for data protection

Data breaches can devastate an insurer’s reputation. Quality engineering in automation testing addresses security concerns by:

Security is a top priority for insurance applications. It safeguards sensitive customer data and ensures regulatory compliance. Vulnerability assessments can identify potential threats such as SQL injection or cross-site scripting. Such threats tend to compromise the system.

Data encryption is another essential measure, protecting sensitive information during transmission and storage. It prevents unauthorized access. Compliance checks ensure that the application adheres to GDPR, HIPAA, and PCI DSS. These practices strengthen the security framework, build customer trust, and mitigate risks.

Security testing is an essential component of software quality engineering. It safeguards both data and trust.

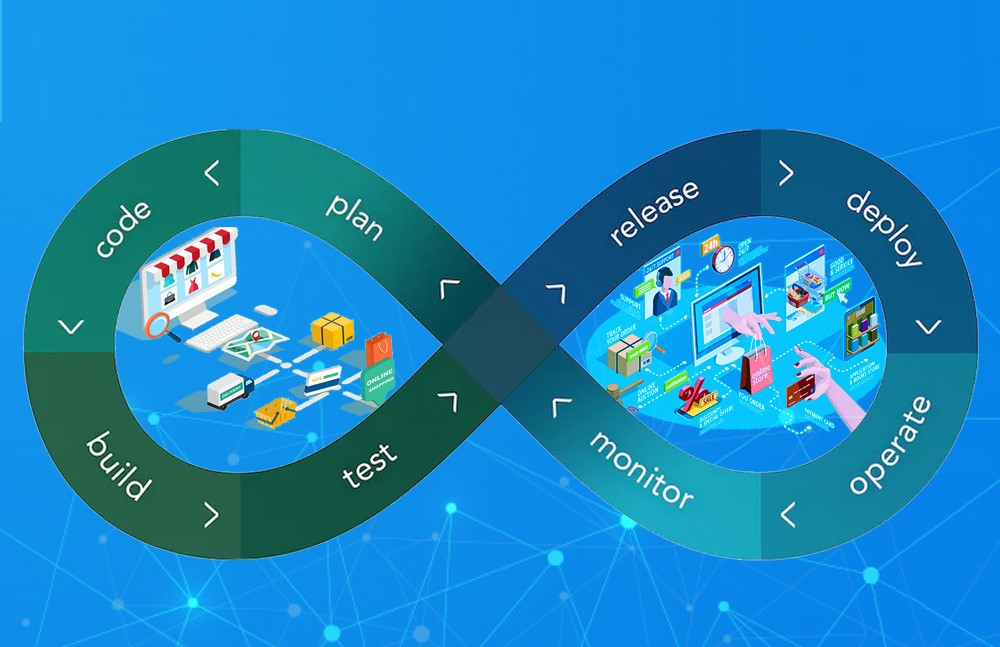

4. Continuous Integration and Continuous Testing (CI/CT)

Modern insurance applications need constant updates to stay competitive. Quality assurance companies deploy CI/CT pipelines to ensure:

- Frequent testing: Automated tests run with every code update, catching defects early.

- Seamless deployments: Continuous integration ensures smooth integration of new features without disruptions.

- Faster time-to-market: CI/CT reduces delays, enabling insurers to stay ahead of competitors.

5. Functional testing for end-to-end validation

Every insurance application must function well. Functional testing validates core processes like:

- Claims management: Ensuring accurate claim submissions and tracking.

- Policy management: Validating smooth policy creation, renewal, and termination workflows.

- Payment gateways: Testing secure and seamless payment integrations.

With quality engineering in automation testing, functional testing becomes more efficient. It minimizes the risk of defects reaching production.

Benefits of quality engineering testing for insurers

Insurance providers that invest in software quality engineering gain significant advantages:

- Improved customer satisfaction: Bug-free applications ensure smooth user experiences.

- Cost savings: Automation reduces manual effort, cutting operational costs by up to 40%.

- Faster deployments: Continuous testing accelerates feature rollouts.

- Enhanced security: Rigorous testing prevents breaches and ensures compliance.

- Future-ready systems: Scalable applications prepare insurers for growth and innovation.

Real-world impact of quality engineering

1. Driving operational excellence

Quality engineering transforms insurance operations by ensuring seamless system performance and reliability. It streamlines claims processing, enhances underwriting accuracy, and improves customer portal functionality. Robust testing minimizes downtime, prevents errors, and ensures seamless user experiences for insurers.

2. Enhancing customer satisfaction

Quality engineering uses automation to cut processing times and remove bottlenecks. This translates to faster claims settlements and smoother interactions for customers. It also ensures data security and compliance. It builds trust and fosters long-term relationships in a competitive market.

Best practices for implementing quality engineering

Insurers must follow these best practices of quality engineering in automation testing:

- Define clear objectives: Align testing goals with customer satisfaction and compliance.

- Choose the right tools: Invest in automation tools that suit application’s requirements.

- Collaborate with experts: Partner with a quality assurance company for their expertise.

- Continuously optimize: Keep checking testing processes and refine strategies for improvement.

The future of quality engineering in insurance

The future of insurance applications depends on AI, machine learning, and predictive analytics. These technologies will drive smarter testing practices, making applications more efficient and resilient.

Insurers must embrace these innovations. Investing in software quality engineering will help them gain a competitive edge. Doing so helps deliver exceptional customer experiences while ensuring operational excellence.

Use only the best services for quality engineering testing in insurance

Qualitest specializes in quality engineering in automation testing for the insurance industry. They deliver tailored solutions that address your unique challenges. They automate testing processes and enhance security and performance.

Partner with us to achieve:

- Faster time-to-market with reduced testing cycles.

- Comprehensive testing coverage for seamless functionality.

- Secure, scalable applications that meet regulatory standards.

Contact Qualitest today and discover how their expertise can transform your insurance applications. You can expect reliable, future-ready solutions.

Integrating quality engineering into your testing processes enhances your insurance applications. It helps build customer trust. Start your transformation journey with Qualitest!